Geofencing for targeted new customer acquisition

Trade fairs are finally taking place again and are therefore well attended. Thus, with “Fleet!” Germany’s largest fleet trade fair and THE meeting place for the fleet industry opened its doors in March once again. One of the exhibitors was a large automotive company that asked itself the following questions, among others: “How do my stand visitors actually describe themselves and are they different from other trade show visitors? How can I address my visitors digitally in compliance with data protection regulations? How can I find and advertise to similar target groups?”

The automobile manufacturer turned to Schober with these questions in mind and commissioned a so-called geofencing project there.

We would now like to introduce you to what geofencing actually is, how it works and what added value it offers advertisers.

Movement points in polygon

What is geofencing?

Geofencing is a technology that allows certain actions or events to be triggered when a mobile device or a GPS-enabled device enters or leaves a predefined geographic zone or fence (“geofence”). This can be used to send notifications, collect data or perform other actions as required.

Tracking is, of course, carried out on an anonymized data basis and in strict compliance with data protection regulations via mobile devices that cross the geofence boundary.

So how exactly does this work?

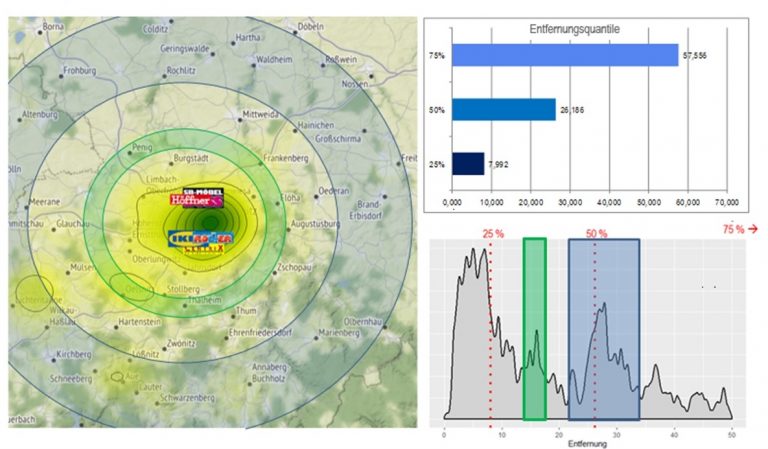

The method uses smartphones as a database, on which users have given certain apps access to their location. The device then sends geo-coordinates with a timestamp to the app publisher at specific intervals. Schober then uses the non-personal data and continues to match it at the cell level against the Schober data universe in a manner that complies with data protection regulations. On this basis, some descriptive features can be temporarily enriched for qualification purposes.

For the concrete geofencing analysis, the Schober analysis team first needs content input on the event: date, time, location, areas, booths at the trade fair. Then, using the supplied input in the form of hall plans, maps and drawings, the defined areas are geocoded and geographically accurate polygons are used to delineate the desired locations and times.

How does geofencing benefit our automotive company?

Massive increase test drives

Our car manufacturer uses Schober’s geofencing methods described above to gain deeper insights into its trade fair visitors – and this goes far beyond the purely quantitative recording of event visitors. This is because the added value clearly lies in the data protection-compliant utilization of these findings for marketing purposes.

Schober Senior Consultant and Geostrategist Sven Waldenmaier explains: “By temporarily enriching valuable additional information from our unique data universe, event visitors can be delimited as target groups at the cell level and described in more detail. Our customers can first address event visitors digitally in a targeted manner, for example for an event follow-up. In addition, the target group descriptions can be used to form so-called look-alikes (i.e. similar target groups or potential new customers) in the Schober data universe in compliance with data protection regulations, which can then be addressed online and offline as part of accurate marketing campaigns via various channels.”

And that doesn’t just apply to trade fairs and events! Geofencing can be applied to any point of interest (POI). “We also collected information on car dealership visitors. This means that current visitors from one or more car dealerships – our own or those of our competitors – were collected, analyzed and addressed with marketing messages in a qualified manner. In one specific case, it was already possible to more than double the number of test drives using this method,” continues Sven Waldenmaier.

General usage possibilities of geofencing

So it can be concluded: By means of geofencing, it is possible to quantify the anonymous visitors to a POI, to qualify visitor groups, and to address them specifically afterwards in order to gain high-quality new leads.

Through the unique combination of mobile movement data with valuable additional information, geofencing enables companies in all industries to generate new types of added value for their marketing.

Movement frequencies

Below are a few more examples of the many uses of geofencing analysis:

- Location planning: Where do high-affinity target customers live? Where is a branch worthwhile, where not?

- Catchment area analyses: Where do my store visitors live and how can they be described?

- Advertising effectiveness checks: Who reads my advertising digitally and comes to the store, who reads print advertising and orders online? Can this be used to optimize distribution areas

or distribute digital advertising in a more targeted manner? - New customer acquisition: Which channels can I use to get similar target groups excited about my products?

- Competitor monitoring: Which customers also go to the competition? How are they different from loyal customers? Which customers seem at risk of churn?

These and many other questions can be answered comprehensively with geofencing technology in combination with Schober’s data universe and analysis know-how.

Incidentally, geofencing also plays an important role in fleet management with the aim of more efficient fleet management. If a vehicle crosses or leaves defined geographical fences, the geofencing system registers this and triggers a notification or alarm. In practice, this is successfully used, for example, to locate vehicles, prevent theft, reduce costs through route tracking or increase fleet productivity.

Which brings us back to the starting point of “Fleet! The industry get-together! The next two-day fair is not far away. Just like the other motor shows that are still to come, from Retro Classics to the IAA. Why not do as our car manufacturer does, learn more about your visitors and address them specifically.

Our geomarketing expert Sven Waldenmaier is looking forward to entering into a dialog with you and providing you with comprehensive advice.

Feel free to contact him directly HERE.

Your Schober Team