With geo-analytics for customer loyalty

Hotspots for the new store concept: Where have customers migrated to and how do companies retain newly acquired customers?

by Sven Waldenmaier, Geo Specialist and Teamlead Sales at Schober

There is no doubt that the Corona pandemic had a strong impact on the store business and customer loyalty. For a long time, stores were closed altogether, so consumers sought alternative ways to shop. But which developments will remain, which will disappear? A large drugstore chain approached us with this question. The aim: to review the store network and realign it if necessary. Because sales can only bubble up where there are customers. So where are the customers?

Evaluate spaces qualitatively and quantitatively

The starting point of our analyses were two central questions. First, how can areas be quantitatively assessed using data to identify hotspots? Secondly, it was also about a qualitative classification of customers. After all, it is of little use if you operate a store at a frequented location but there is little demand for the drugstore’s offering there. A gas station in the pedestrian zone makes no sense, that is immediately clear. For less obvious cases, however, business decision-makers need more in-depth information – on the purchasing power of pedestrian flows, for example. This is because, in extreme cases, the costs for the store can be higher than the sales that can be generated. The Apple Group may take that on itself with its brand stores, because it’s all about awareness here. Our drugstore chain, however, pursues a different business model, with the store as the central distribution channel.

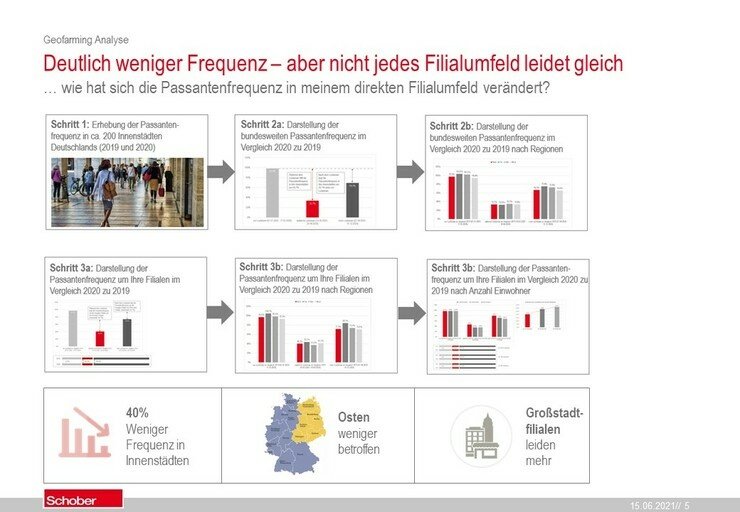

We therefore started with a nationwide analysis of pedestrian flows in around 200 areas with a high density of stores – i.e. pedestrian zones, city center locations and shopping centers. The Schober Information Group has more than 55 million “Unique Mobile IDs”. On the basis of these anonymized identifiers, which comply with data protection regulations, pedestrian flows in defined areas can be read and interpreted. The procedure in detail:

- Step 1: Definition of grids (170m edge length) around the respective location of the existing stores.

- Step 2: Specification of the pedestrian frequency per grid. How does this compare to the national average, and how does it compare to other downtown areas?

- Step 3: How high is the proportion of people with an affinity for drugstores in the respective area compared to Germany as a whole?

Qualify, qualify, qualify

Step three is crucial for supplementing the initially purely quantitative view with qualitative characteristics and thus gaining truly sales-promoting insights. Based on affinities, pedestrian flows and store visitors can be more precisely qualified and conclusions drawn about interests. Anyone who goes to a gym three times a week has a higher affinity for sportswear and personal care (at least I hope so) than other passersby. On the other hand, people who stroll through the pedestrian zone of a large city every day (even on Sundays) are more likely to be looking for entertainment than specifically for purchases. Those who primarily frequent discount stores are more price sensitive than the subscriber to a high-end luxury spa downtown. Which competitors have visitors to my drugstore visited before and what do they buy then? Now, the data is collected anonymously, but crucial insights can be drawn from the aggregate.

Along the analog customer journey

Even more insights are gained by using third-party data – such as the Schober data universe – for the analysis. Our drugstore chain specifically used this sociodemographic data to additionally determine purchasing power, family structure, living conditions and many other attributes of the pedestrian flows in the store environment and the store visitors. In this way, it is possible to see how the residents of a villa suburb with high purchasing power prefer to store or where families from the “Speckgürtel” of Hamburg, Dresden or Cottbus go shopping. The examples show: Geomarketing makes the analog customer journey – places, routes, purchases – of customers transparent and thus controllable.

Profiling so that customers and suppliers benefit equally

After all, only those who know where their target customers spend their time, where they go shopping, and what other interests they have can create target group and visitor analyses with a high degree of precision. This is the prerequisite for profiling the target groups according to personas and, as a result, for a sales-boosting approach: at which location should billboards draw attention to the store offer, where should brochures be distributed, who should be lured into the outlet with offers? In addition, locations can be accurately assessed and hotspots identified. If you profile your target groups, you can respond more precisely to their demand and make offers where it is highly likely that sales can be turned around. And in the same way, these insights can also be used to make targeted online offers that supplement the branch network as the main sales channel at key points.

What remains, what disappears?

So back to the drugstore chain and the consequences of the pandemic: How badly has the store environment suffered? How much did the frequency of store visitors decline and how quickly did it recover after the lockdowns? What is the role of incidence values, location, environment? We had investigated this and, in the case of drugstores, found increasing store visits. Of course, because drugstores, as suppliers of daily necessities, remained open during the lockdown – in contrast to perfumeries and sports stores, which had to switch completely to online.

Procedure geofencing analysis

The migration of customers away from specialist retailers is therefore actually an influx for drugstores – new customers were gained in the high-priced fragrance segment, among others, and sporting goods were also in high demand. Will new customers remain loyal to drugstores after the lockdown? The analyses from geomarketing show that a remarkable 17% of customers who frequented different chain stores before the lockdown remain exclusively with drugstores after the lockdown. The optimal response to this change depends on the perspective: Specialty retailers such as perfumeries and sporting goods stores attract – according to the analysis of passers-by and visitor flows – above all a clientele with purchasing power in the 40 to 59 age group, who also otherwise move around spas and beauty salons, exclusive fashion boutiques and delicatessens. To win back these customers, retailers would have to expand their stores in the identified hotspots. Drugstores, on the other hand, should supplement their traditional high-turnover locations in the vicinity of cinemas, fitness studios or stores for baby supplies with new locations in lifestyle hotspots with an extended product range. In addition to the choice of location, joint marketing activities with suitable corporate partners from the areas identified by geomarketing are also promising – cross-selling and co-marketing can sustainably bind the new customers.

The biggest competitor, however, remains purchasing on the Internet. That’s why all chain stores should follow three maxims: Invest in hotspots and the right assortment, complete your branch offering with a web store and, above all, think branch and online store together. After all, retailers only generate revenue if they are present in the exact place where their customers are.

Seven key questions: Is your branch network optimally aligned?

- Do you know who visits your stores and with what frequency?

- Can you identify hotspots nationwide?

- Where do customers migrate to, where do you gain customers from?

- Are you leveraging your cross-selling and upselling potential against neighboring businesses?

- Do you know the analog and digital customer journey of your target groups?

- Can you profile target groups for a sales-boosting approach?

- Do you think branch and online business integrated?

Let’s talk about your individual challenges!

I look forward to learning more and engaging in dialogue with you.

Feel free to contact me directly HERE.

Your Sven Waldenmaier

This article appeared on 21.06.2021 in Marketingbörse magazine, among others.