MULTI BUYER ANALYTICS FOR MORE CUSTOMER LOYALTY

“Mmmh, delicious – I love these energy bars after sports and buy them again and again”, my friend tells me and gives me her discount code for the new bar. My friend is a loyal customer who even acts as a brand ambassador – that’s a dream result for marketing activities.

And multi-buyer analytics are essential.

Intensive customer loyalty

But before we get to the analytics, let’s take a quick look at the bigger picture: Acquiring new customers is time-consuming and requires significantly more effort than intensifying existing customer loyalty. This has been proven by many studies and surveys. And this experience applies not only to the sale of energy bars, wine or travel to end customers, but also in B2B business. Craftsmen who have good experiences with their suppliers, for example, buy regularly and usually also larger baskets of goods. So let’s intensify customer loyalty!

“Mmmh-delicious-moments” or: Knowing customers in order to bind them specifically

Customer loyalty is hugely important, as my Buddy illustrates. Satisfied regular customers are loyal, tolerant of mistakes and recommend products to friends and colleagues. In times of social media, this also means that loyal customers recommend a product to many people in their social network. How do you win loyal customers and create these “Mmmh delicious moments”? How do companies increase customer loyalty and turn single buyers into multiple buyers? Of course, a good product range is a basic prerequisite. But it is also crucial to know your customers inside out. Knowing what moves them, what excites them and what motivates them to buy again. The key to this: Multi Buyer Analytics.

Evaluate purchases with Multi Buyer Analytics

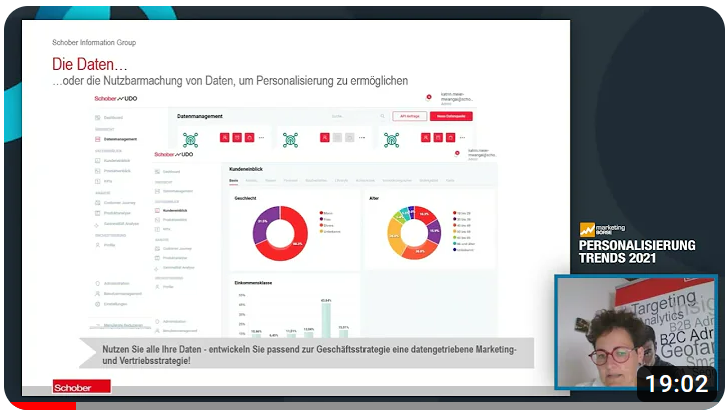

Companies that use multi-buyer analytics are significantly more successful than their competitors. This is proven, among others, by a power bar manufacturer and Schober customer who uses Multi Buyer Analytics based on our universal data platform (udo) with great success. The first thing to do is to get a solid overview of purchases and buying habits.

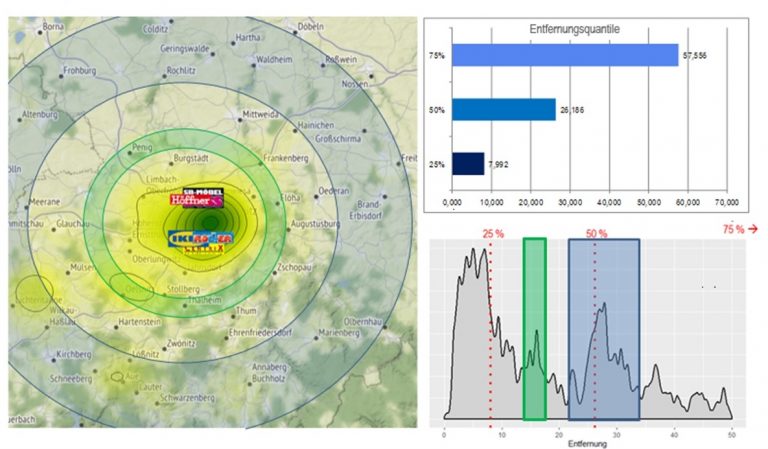

Which customers only buy once and then disappear from the radius of marketing measures? Which customers, on the other hand, buy multiple times? With the answers, segments for subsequent measures can already be created in a first approximation. If you add the time intervals between purchases and the product groups purchased in each case, the view of the customers quickly becomes complete.

Which customers only buy once and then disappear from the radius of marketing measures? Which customers, on the other hand, buy multiple times? With the answers, segments for subsequent measures can already be created in a first approximation. If you add the time intervals between purchases and the product groups purchased in each case, the view of the customers quickly becomes complete.

For example, it can be determined that a so-called persona of multiple buyers prefers to buy a certain product in larger quantities, but then does not order anything else for a longer period of time. Another, however, orders small quantities more frequently, but these come from different product areas – energy bars, protein shakes and isotonic sports drinks.

Product mix analysis

Product mix analyses go deeper, allowing the correlations between individual offers to be determined at product level. In the case of the power bar manufacturer, for example, flavor, price and container size are related. For other Schober customers, such as the water specialist bevo, it is water pipes, connecting sleeves, special adhesives and hoses. Whatever the product portfolio looks like, a product mix analysis of purchases reveals valuable synergies for existing customer care. Of course, it is precisely these correlations that must first be drawn from the data through analysis. To make this possible even without studying mathematics, udo offers intuitive ready-to-use analytics.

Targeting customer loyalty measures

Targeted analysis of purchase and customer data as part of multi-buyer analytics provides crucial knowledge about customers. Single and multiple buyers and their respective preferences can be precisely identified so that marketing and sales can use targeted communication measures to stimulate customer loyalty and new purchases. The right triggers and purchase motivations can then be set along the customer journey: The targeted development of existing customers can begin – from single to multiple buyers, from loyal customers to brand ambassadors. Of course, many factors – market, target customers, budget, creativity and others – play a role in the measures. The right mix of measures is therefore always individual.

We have compiled five key success factors and reasons for multi-buyer analytics in a checklist, which you can download for free below.

Back to the gym

But let’s get back to the power bar manufacturer and its case. The company used multi-buyer analytics to initially segment the buyers of its products in a targeted manner and cluster them according to buyer groups. One key finding: the number of repeat buyers can be increased particularly quickly through targeted cross-selling. From the product mix analysis, it was clear that energy bars are a low-threshold, “fast-turnaround” offering and sell very well along with energy gels in the gym environment.

Sports studios are a top sales venue, but buyers have remained unknown. A persona-based campaign has therefore been launched: buyers of energy bars can request free samples directly from the company by providing their contact details. This provides an opt-in and builds loyalty, because who doesn’t feel connected to their provider when asked for their opinion on the new bar? And secondly, you use targeted discounts and evaluate interactions in order to retain customers and acquire new ones.

By the way, it happened to me personally in the same way. I actually tried the new energy bar on the recommendation of my friend and with the discount code, was thrilled and now also buy this brand regularly.

Single to multiple buyers: customer loyalty thanks to multi-buyer analytics

If you’re thinking, “That’s easy for them to say. But the effort to introduce multi-buyer analytics is huge, isn’t it?” No, the effort is manageable, because Schober has developed a cloud-based out-of-the-box platform from the method presented. We call the solution udo and think you should get to know udo. We’ll be happy to show you how to turn single buyers into multiple buyers with udo. If you have any questions, please do not hesitate to contact us at[at]schober.de.

If you’re thinking, “That’s easy for them to say. But the effort to introduce multi-buyer analytics is huge, isn’t it?” No, the effort is manageable, because Schober has developed a cloud-based out-of-the-box platform from the method presented. We call the solution udo and think you should get to know udo. We’ll be happy to show you how to turn single buyers into multiple buyers with udo. If you have any questions, please do not hesitate to contact us at[at]schober.de.

Good luck and long live your sales!

Your Schober Team

Multi Buyer Analytics Checklist

The top five reasons to use multi-buyer analytics for customer engagement: Are your customers buying, but only once? Would you like to reduce the enormous costs of acquiring new customers? Do you have long-standing customers but hardly any sales?

Learn the top 5 reasons for multibuyer analytics and customer engagement in our checklist.

Click here to download for free:

Data is silver, but good data is gold, because only from it can companies gain the information that determines market success. The analyses become more accurate, leads can be assessed more precisely and customer interaction becomes more precise overall. “Get the basics right” is what we say at Schober and

Data is silver, but good data is gold, because only from it can companies gain the information that determines market success. The analyses become more accurate, leads can be assessed more precisely and customer interaction becomes more precise overall. “Get the basics right” is what we say at Schober and

Scissors, stamps, furniture or cleaning supplies – if you’re looking for office supplies, you’re in good hands at Viking in Germany. The office supplies retail brand, which is part of the European Office Depot group, is now successful in eight European countries and employs over 1,500 people in Europe. Viking’s recipe for success: one stop store for your workplace, innovative and data-driven marketing, and great customer service.

Scissors, stamps, furniture or cleaning supplies – if you’re looking for office supplies, you’re in good hands at Viking in Germany. The office supplies retail brand, which is part of the European Office Depot group, is now successful in eight European countries and employs over 1,500 people in Europe. Viking’s recipe for success: one stop store for your workplace, innovative and data-driven marketing, and great customer service.